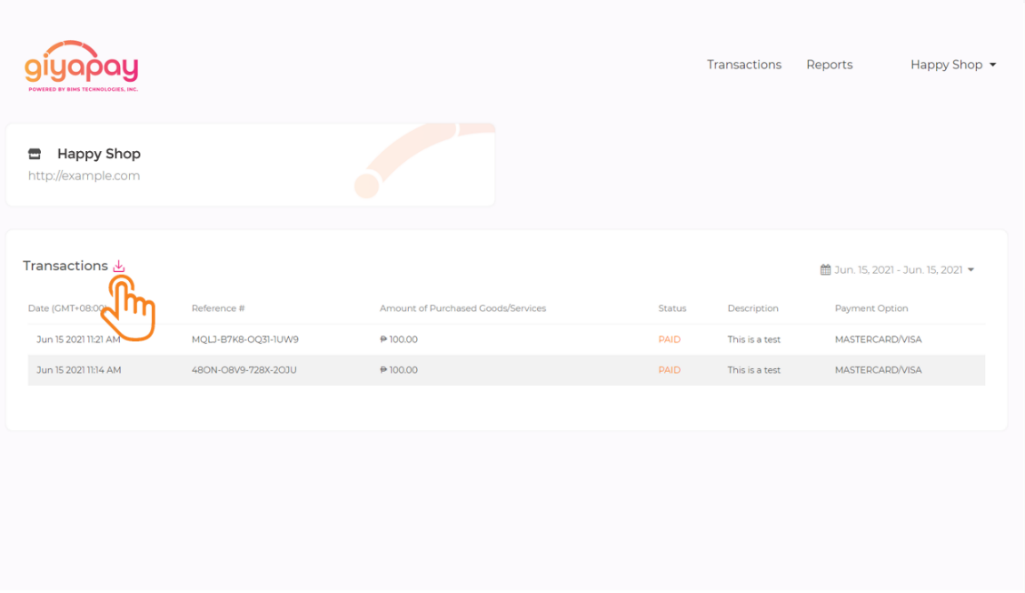

You can view successful payments in your Merchant dashboard. The dashboard is updated in real-time and will only show transactions that have been successful.

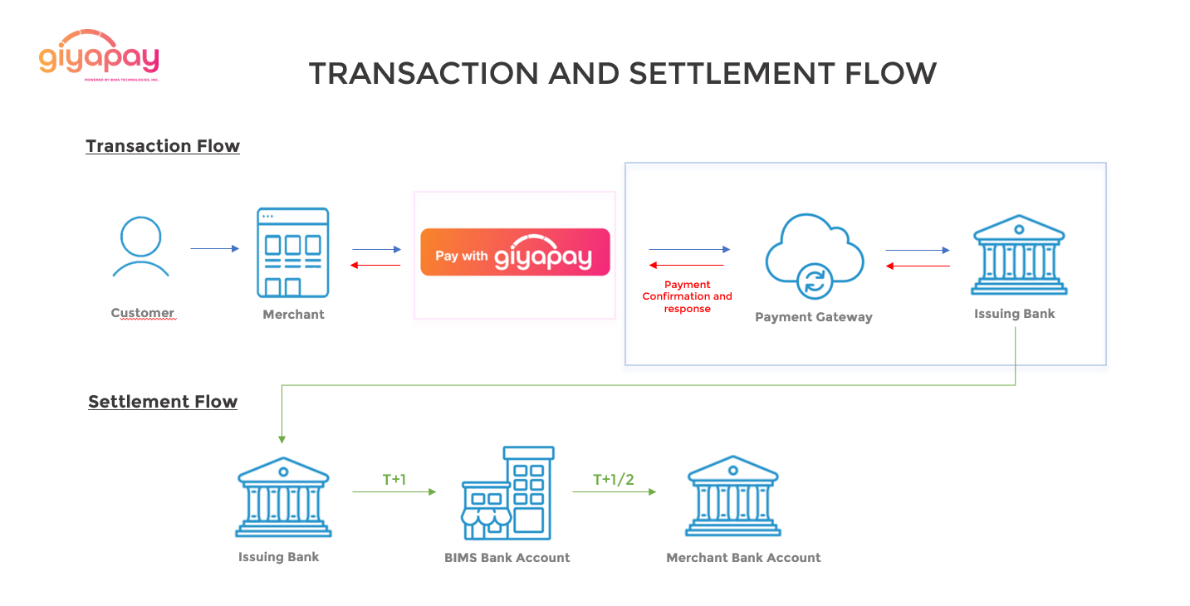

We follow a T+1/2 settlement. Our cut-off is at 9 pm every day. Payments will be deposited straight to your nominated bank account which you will be indicating in the signed contract.

We follow a T+1/2 settlement. Our cut-off is at 9 pm every day. All purchase and sale transactions done on T Day are settled on a T+2 basis. T= Trading Day and +2 = 2 consecutive working days after (excluding all holidays). Payments will be deposited straight to your nominated bank account.

You can download transaction reports through the option in your Merchant dashboard.

Simply click the icon beside the “Transactions” heading and a CSV file of your daily transaction reports will be ready for download.

Your downloadable reports will include the following information:

· Date

· Reference Number

· Net Amount

· Hold Out Columns

- Percent (%)

- Amount (PHP)

- Release Date

· Status

· Description

· Payment Option

Yes, our daily transaction reports will indicate transactions from 9:01 pm (T-1) the day before until 9 PM (T0) of the current day.

You can find and download your daily transaction reports by clicking the “Transactions” button on your Merchant dashboard.

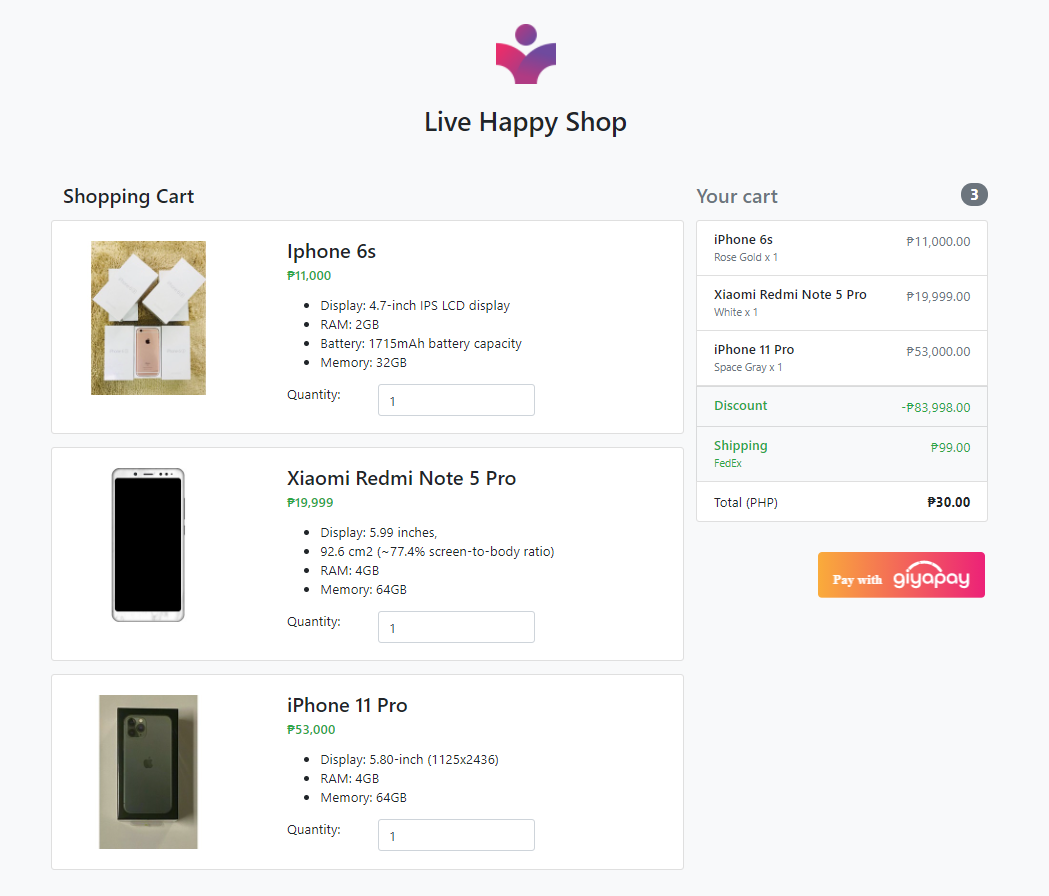

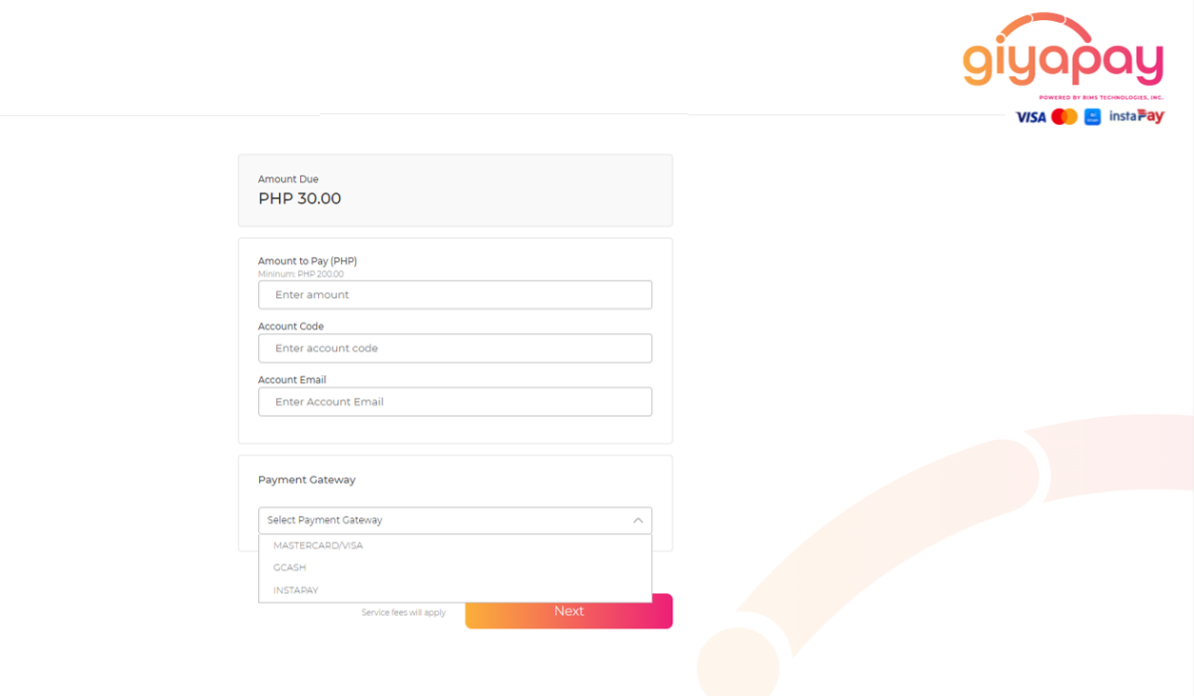

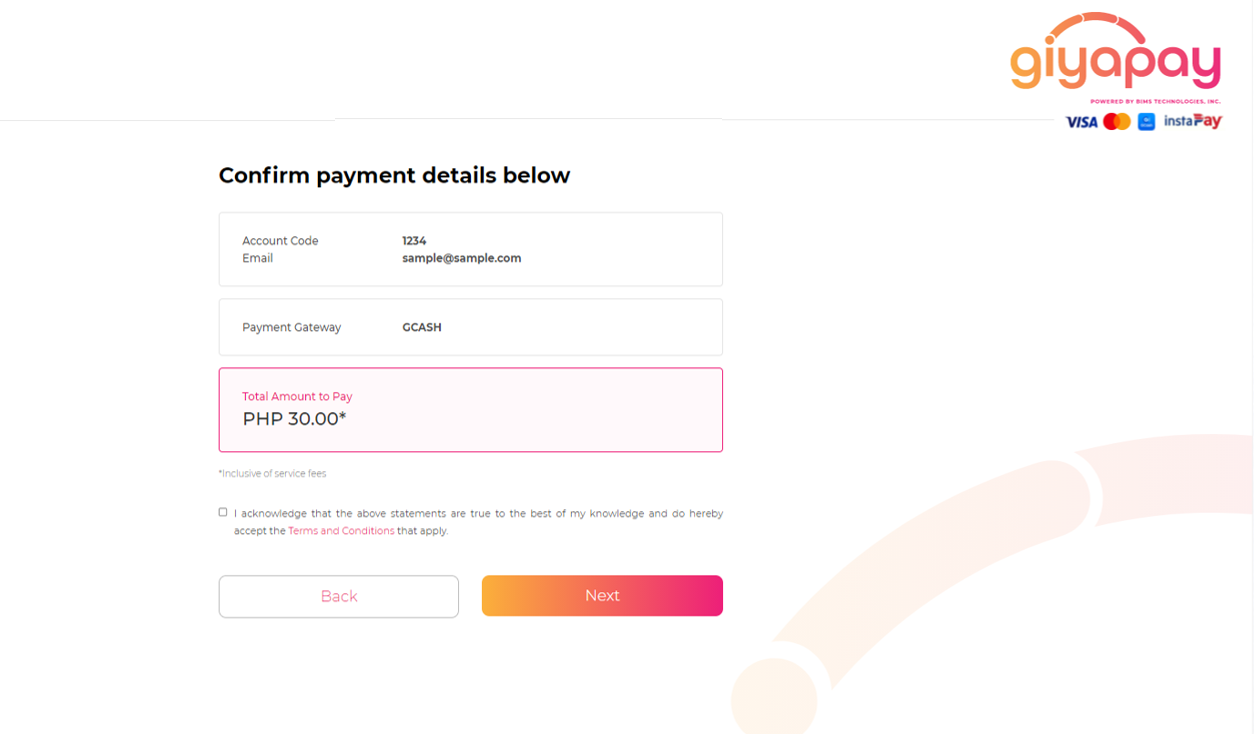

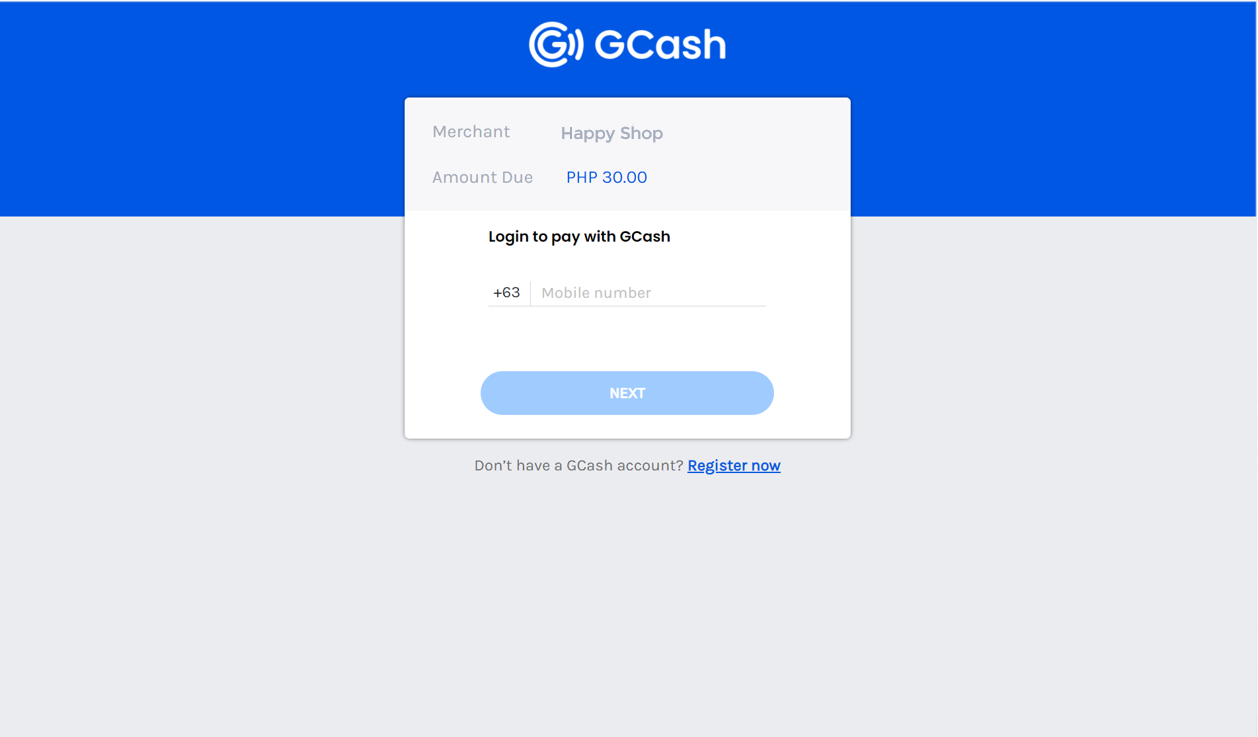

Payors can make a payment by following these steps:

1. Click on the “Pay with GiyaPay” button or Individual Gateways (if this is an availed feature).

2. Fill up the additional fields (if this is an availed feature) and choosing their preferred payment Gateway.

3. Confirm Payment details.

4. Fill up the necessary details required by their chosen Gateway (this portion is a domain hosted by the gateway themselves).

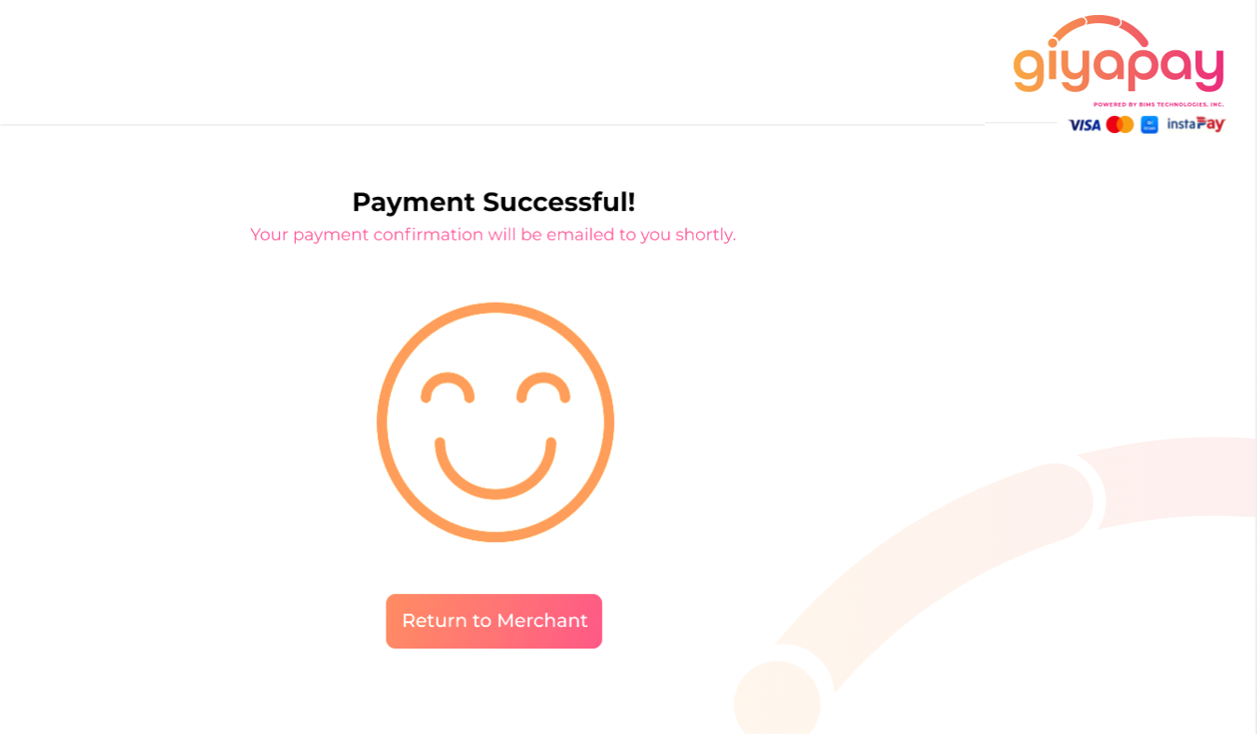

5.They will receive a successful payment notification on their screen after filling up the necessary details.

Additionally, Payors can be redirected to your website where our hosted buttons are integrated through links or QR codes that we can provide for you.

Unfortunately, we do not process refunds. Requests for refunds, returns, and/or exchanges shall be made directly with the merchant concerned, in accordance with the said merchant’s own policies regarding the matter.

GiyaPay can accept payments through:

Credit or Debit Cards

· Mastercard

· UnionPay

· Visa

e-Wallets

· Alipay

· GCash

· GrabPay

· PayMaya (coming soon)

· WeChat Pay Online Banking

· InstaPay

We can issue payouts to your nominated bank account only and not to e-Wallets.

There is no required minimum amount for payouts. Instead, there is a minimum number of transactions per day needed to receive your payouts.

For T+2 settlement: at least 10 transactions per day.

For T+1 settlement: at least 50 transactions per day.

You may accept payments from outside the Philippines but GiyaPay can only process in Philippine Peso.

Payments made in other currencies may be charged an extra conversion fee by Payor’s bank abroad to convert payments into Philippine Peso.

Once a chargeback is filed, the value will be deducted from the Security Bond you place upon signing with us.

We will hold on to the equivalent value until after 30 days (grace period given by banks) to create a dispute on any of the billed transactions made on their credit card.

After 30 days, this amount will then be part of the credited value to your account due on the 31st day together with your daily sales excluding the current day’s hold out amount if dispute is deemed to be valid.

Our team will quickly reach out directly to you via email informing you about the formal dispute made.

Once the value of transactions over the internet through GiyaPay has exceeded One Million Pesos (PHP 1,000,000.00), we will begin to Hold Out two percent (2%) per transaction and charge succeeding chargebacks through that Hold Out value.

You will be provided the disputes made and the corresponding chargeback value that will be deducted from the total sales due to you that day.

No, we do not issue receipts to the Payor, rather, receipts are often issued by businesses. GiyaPay is only a payment integrator.

Common reasons why payouts might be delayed are:

1. Account Verification issues :A GiyaPay representative will reach out to you directly via email explaining why your payout is being held back.

2. Misunderstanding of the payout schedules: GiyaPay follows a T+1/2 settlement which means payouts will be processed to your account the next day or the day after tomorrow.

3. Transfers are still being processed by the bank: Reflection of the payout will depend on your receiving bank’s schedule. Although this often reflects in your bank within the day, there are cases that your bank will take one to two (1-2) days to process the transfer.

4. Incorrect bank account details: A GiyaPay representative will reach out to you directly via email informing you to update your bank account details.

Transaction limits are defined by the guidelines of each e-wallet or payment processor. GiyaPay does not define the limit per payment method.

The following banks are allowed for Payouts:

· Australia and New Zealand Bank (ANZ) – Philippines

· Asia United Bank (AUB)

· Bangkok Bank - Manila

· Bank of China – Manila

· Bank of Commerce

· Banco De Oro (BDO) Unibank

· Bank of the Philippine Islands (BPI)

· Chinabank

· Citibank Manila

· CTBC Bank – Philippines

· Development Bank of the Philippines

· Deutsche Bank - Manila

· EastWest Bank

· HSBC – Philippines

· JPMorgan Chase Bank Manila

· KEB Hana Bank – Manila

· LANDBANK

· Maybank Philippines

· Mega International Commercial Bank – Manila

· Metrobank

· Mizuho Bank – Manila

· MUFG Bank – Manila

· PBCOM

· Philtrust Bank

· Philippine National Bank (PNB)

· Philippine Savings Bank (PSBank)

· Rizal Commercial Banking Corporation (RCBC)

· Security Bank

Is your bank not included in the list? You may email our customer success manager (CSM) or email us at [email protected].

The most common reasons for failed or declined payments are:

1. Invalid details: Kindly ensure that you provided accurate details to your chosen gateway are accurate.

2. Bank declines: Banks have their own criteria for online payments which are also known to affect other payment providers. It is encouraged to let Payors call their respective banks to allow transactions to proceed.

3. Failure to authenticate: Certain payment methods might require Payors to input OTPs sent via SMS. Failure to input the required OTP will not allow the transaction to be authorized and will not push through.

4. Insufficient Funds: Certain payment methods require to have enough amount in the Payor’s account within their system. It is encouraged to have the Payor check their balance for transactions to proceed.