View all questions

View all questions

View all questions

View all questions

View all questions

View all questions

View all questions

Click here to view

Click here to view

Click here to view

Click here to view

Click here to view

Click here to view

Click here to view

GiyaPay is a third-partypayment solution that unifies a variety of online payment gateways into onepayment button. It aims to provide easy-set-up, easy-to-use online payment system with a simplified user journey for the payor, and consolidated reports for business.

GiyaPay makes payment options more accessible to

you with a simple application process and provides the following services:

•Flexibility and add-on features for you to choose from.

•GiyaPay API that

integrates directly with your website providing payors a seamless payment experience

without needing to be redirected outside your page.

•GiyaPay links that allows

you to send a link anywhere whether on email, SMS, Instant messaging groups, social

media, or etc. that payors can easily open with just one click. Links can also be in

the form of QR codes.

•Technical team that assists you from integration to

account integration and a support team that will answer any queries

post-integration.

GiyaPay provides the flexibility for you to decide

on the features listed below. Each add on feature may have a corresponding service

fee. 1.2.a Determine who will be charged the service fees [Payor or Merchant].

Service fees are charged on a per transaction basis and is comprised of fixed

transaction fees, Gateway MDR, and other applicable fees depending on the

Merchant-Account configuration.• Payor – When service fees are passed on to the

Payor, the Payor will be advised that applicable fees that may apply per

transaction.

• Merchant – When you choose to absorb service fees, the settlement

amount paid to be paid to you will be deducted the corresponding value. A report

will be provided to you through your account.

1.2.b Determine the Gateway Type

more applicable to you [Universal or Individualized].

• Universal MDR – charges 1

single MDR and provides a simpler accounting process for you.

• Individualized

MDR – charges the applicable MDR based on the rates provided per Payment Gateway and

provides a more affordable alternative for you.

1.2.c Decide on additional

fields we can activate for you.

• Specify Amount – this feature enables the payor

to specify the preferred amount that will be paid.

1. Minimum Amount - This

feature allows you to indicate the minimum amount that you find acceptable. If the

amount that the Payor specified is lower than the amount you have indicated,

transactions will be unable to push through.

2. Email - This feature also

includes an email field where the Payor is asked to provide their email address.

Pushing an email confirmation to their address will require a separate fee to

activate.

• Account Code – This field is a free text for payors to indicate

their account reference or subscriber number and helps you identify the Account for

which the payment is being made.

• Gateway Direct - is a unique button per

Payment Gateway that is still powered by GiyaPay. This feature enables you to limit

and expose payment channels you choose to activate.

GiyaPay is not similar to e-wallets. There is no need for the payor to create an account, download an application or register to its service unlike e-wallets. GiyaPay just needs to activate your Merchant Account, integrate our hosted payment button in your website, and you can easily start to accept payments from various payment channels!

GiyaPay uses an SSL encrypted website and is PCI-DSS Compliant. Each payment gateway has their respective security protocols, including possible 2MFA and OTP, which will beat the discretion and responsibility of the Payment Gateway.

Yes, through our Payment Link feature. As for the GiyaPay button, we would recommend having a hosted domain or a centralized payment page where we could attach the GiyaPay button for your payors to pay. We may provide this simple page for you, or we may coordinate with the team who built your website to provide this for you.

Test accounts, sometimes called the Sandbox environment, is the exact replica of the GiyaPay live environment that you can use to test the functionality of the service before making it available to the public. The test account serves as a safe environment to see if all the expected functionalities are working well, before migrating the account into its live account.

You can test GiyaPay's API through the test account or a Sandbox environment that we will provide.

GiyaPay links are provided by us upon request during integration.

GiyaPay QR codes are provided by us upon request during integration.

Yes, our service fees are already VAT-inclusive. There will be no additional deductions for VAT-related charges.

GiyaPay's service charge includes a fixed transaction fee, MDR rates that vary depending on the gateway type(universal or individualized) you choose, and possible additional charges for add-on features you will activate.

Rates will vary depending on the volume of transactions. Any transactions that fall below one thousand per day(< 1000 / day) will fall under the standard rates of GiyaPay.

GiyaPay only supports PHP. Any transactions made from outside the country will be converted to Philippine Peso.

Currently, GiyaPay can only process transactions for Philippine-based companies with Philippine IP addresses. If a Payor were to pay while abroad to your company based in the Philippines with a Philippine-registered website, the transaction will be processed. Any dollar denominated product will be automatically converted using the bank's current conversion rate. Websites will be validated by GiyaPay upon application.

Yes, you can change your email address upon request. The request form can be found within your Merchant dashboard. To know more about the request form, you may go over the "14 After Sales Request and Support" section in our FAQ guide.

You may disable your account upon request. The request form can be found within your Merchant dashboard. To know more about the request form, you may go over the "14 After Sales Request and Support" section in our FAQ guide.

You may change your bank account upon request. The request form can be found within your Merchant dashboard. To know more about the request form, you may go over the "1 After Sales Request and Support" section in our FAQ guide.

Yes, there is a one-year lock-in period in using GiyaPay upon signing the contract.

We are pleased to announce that we have gone

digital in our application process. Before activating your account, we will need the

following information and documents:

Information

a. Nature of Business

b.

Type of Business (Corporation, Sole Proprietorship, Government, or NGO)

c. TIN

Number

Documents

a. Signed Client Agreement Form (contract) via DocuSign

b.

Photocopy of the Authorized Signatory's Valid ID (Front and Back)c. Photocopy of the

Authorized Representative's Valid ID (Front and Back)d. Photocopy of your BIR

Certificate of Registration

Depending on your Type of Business, you

will need to submit the following additional documents:

Corporation / Partnership

/ Cooperative / Association

a. Photocopy of Articles of

Incorporation/Partnership/Cooperative/Association

b. Photocopy of By-Laws or

General Information Sheet (GIS)c. Notarized Certificate issued by the

Corporate/Partner's/Cooperative's/Association's secretary for Authorized

Signatory

d. Photocopy of SEC Registration Certificate

Sole

Proprietorship

a. Photocopy of DTI Certificate of Business Name

Registration

Optional: Eligibility for Tax Exemption

a. Photocopy of Tax

Exemption Certificate by BIR or Authorized Government Agency

Optional: For

Designated Non-Financial Business Profession (DNFBP)

a. Photocopy of AMLC issued

Certificate of Registration/Provisional Certificate of Registration

After you have successfully submitted your request

for account activation, it typically takes 7 business days for our

team to review your application. Our team will send you an email once your account

has been approved or if they have any follow-up questions, such as missing documents

or clarifications about your business.

Yes, the designated bank account for payouts must

be in the name of the business (Corporation, Sole Proprietorship, Government, or

NGO).

Unfortunately, not. Currently, GiyaPay can only

process transactions for Philippine-based companies with Philippine IP addresses.

A GiyaPay Payment Link allows you to accept payments through SMS, Chat, or Email by sending the payor a generated link.

Payment links can be embedded into emails, sent as a text, or shared directly through social media messaging apps (chat).The payor can open the link using any browser.

Payment Links work in three steps:

1. Generate

a Payment Link

2. Share the Link

3. Accept Payments

To know more about

how Payment Links work, you may go over the "13 Payment Links Journey" section in

our FAQ Guide.

There is no need for a website to avail of GiyaPay's Payment Link Feature. You may receive payment via chat, SMS, or email through the generated link.

All datetime is on GMT +08:00.

Unfortunately, we do not support the ability to customize the payment link URL, but you can use a third-party URL shortener to redirect to the payment link instead.

There is no need for a website to avail of GiyaPay's Payment Link Feature. You may receive payment via chat, SMS, or email through the generated link.

All datetime is on GMT +08:00.

Unfortunately, we do not support the ability to customize the payment link URL, but you can use a third-party URL shortener to redirect to the payment link instead.

Yes, GiyaPay Payment Links expire depending on the set date and time upon generating the link.

You cannot reuse an expired Payment Link. You would need to generate a new payment link if the payor missed to pay within the time allotted.

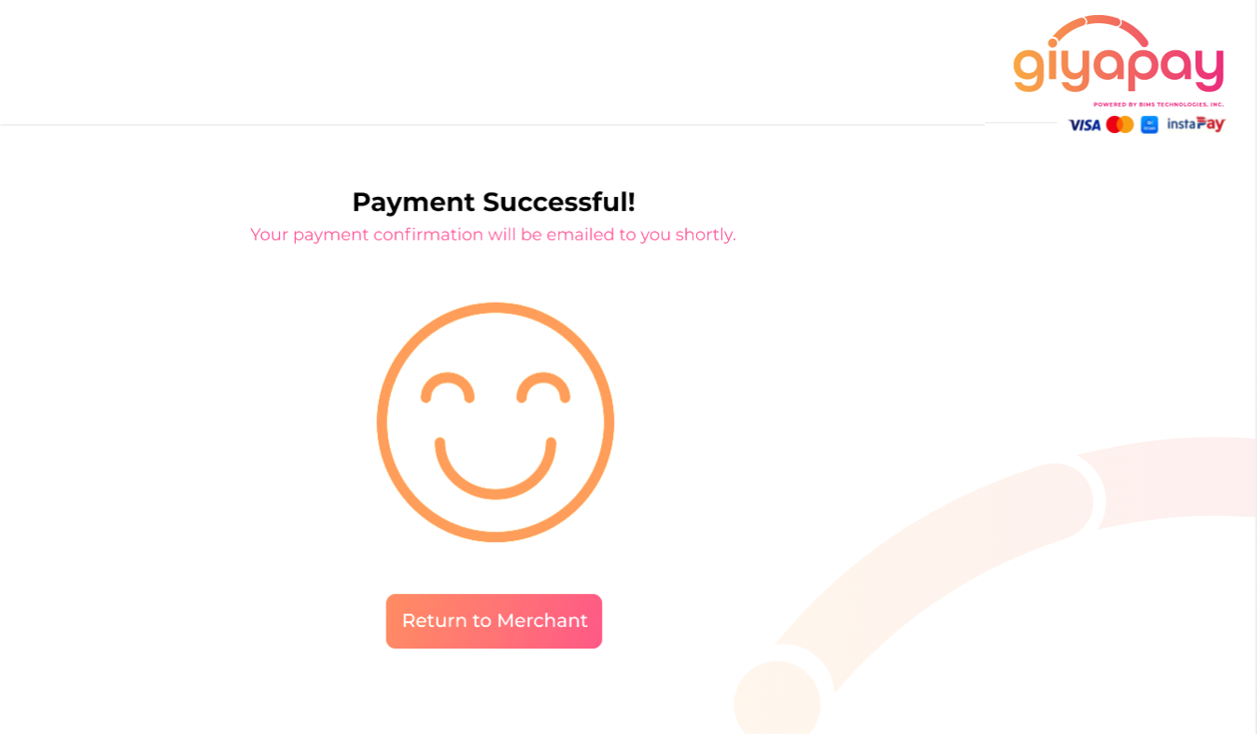

Successful transactions will be seen real-time on your merchant dashboard. A successful payment will be indicated as "Paid."

Payors will be shown a "Successful Confirmation" page once the transaction is deemed successful.

Yes. Payors can access the link again and pay if the payment link status does not have the EXPIRED or PAID status.

Yes. When payors open the link again, they will be able to access the payment page and proceed with the transaction.

Yes. The payment is counted, and you can see the status of the link in the Payment Link Dashboard change into a "Paid" status.

Successful payments are indicated in your Merchant Dashboard. Your dashboard is updated real-time and will only show transactions that have been successful. To know more about the Merchant Dashboard, you may go over the "11 Merchant Dashboard and Downloading Reports" section in our FAQ guide.

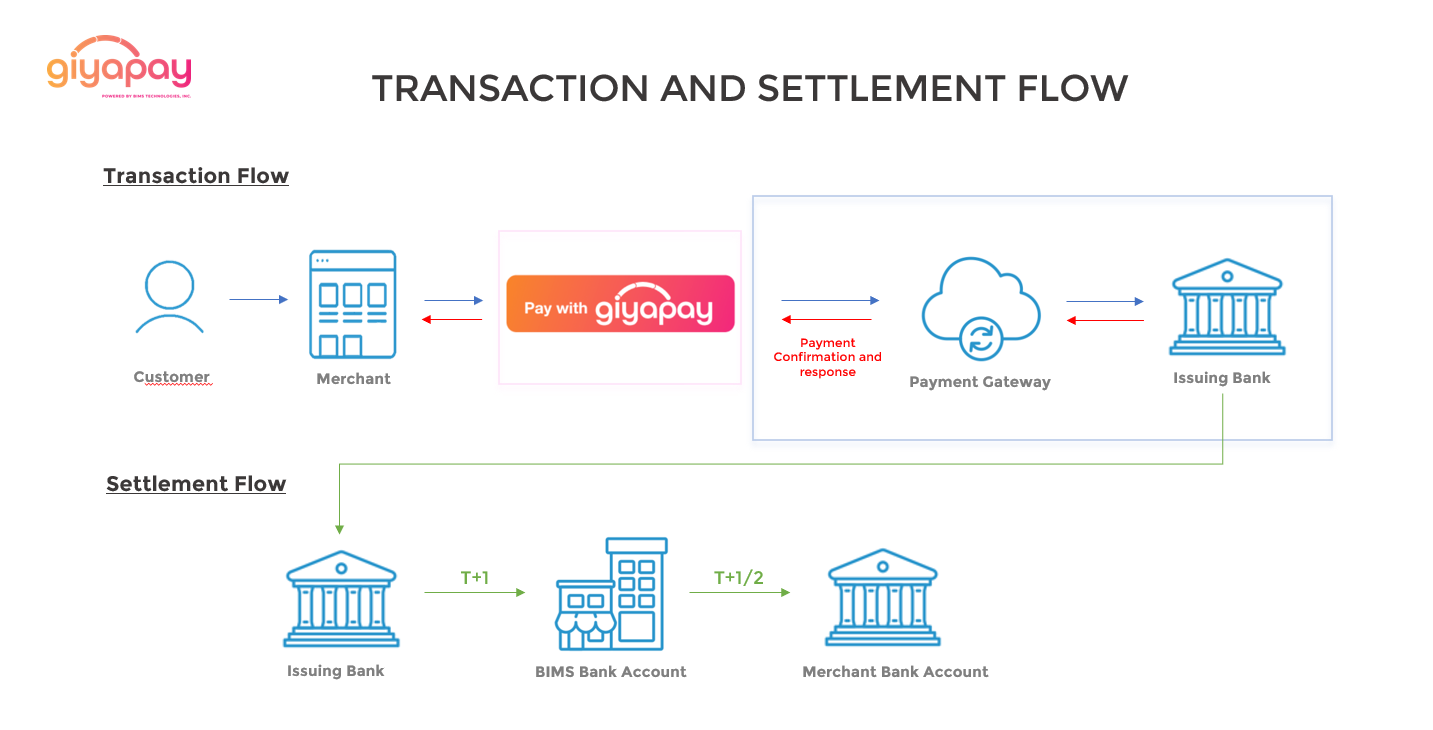

We follow a T+1/2 settlement. Our cut-off is at 9 pm every day. Payments will be deposited straight to your nominated bank account which will be indicated in the signed contract. To know more about our settlement lifecycle, you may go over the "8 Settlement and Transaction Flow" section in our FAQ Guide.

We follow a T+1/2 settlement. Our cut-off is at 9 pm every day. All purchase and sale transactions done on T Day are settled on a T+2 basis. T= Trading day and +2 = 2 consecutive working days after (excluding all holidays). Payments will be deposited straight to your nominated bank ac To know more about our settlement lifecycle, you may go over the "8 Settlement and Transaction Flow" section in our FAQ Guide.

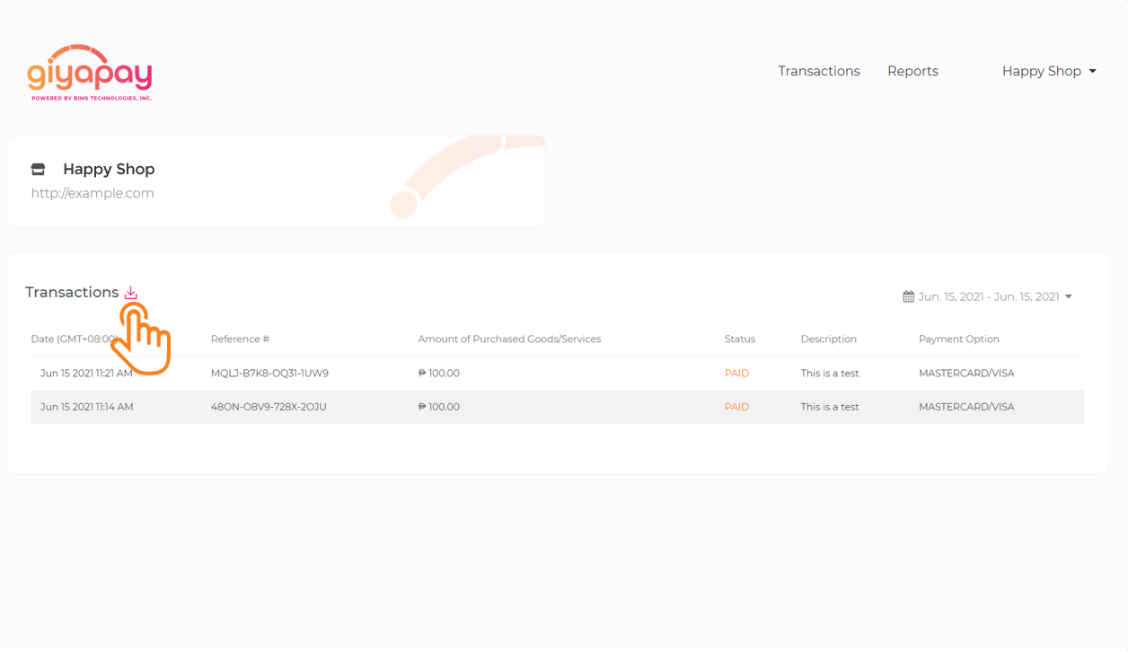

Your Merchant Dashboard provides you the option to download your transaction report. Simply click the icon beside the "Transactions" and a CSV file of your transaction report will be ready for download. To know more about reports, you may go over the "11 Merchant Dashboard and Downloading Reports" section in our FAQ guide.

Yes, our daily transaction reports will indicate transactions from 9:01 pm (T-1) the day before until 9 PM (T0) of the current day. To know more about reports, you may go over the "11 Merchant Dashboard and Downloading Reports" section in our FAQ guide.

Payors can make a payment by:

1. Clicking on

the "Pay with GiyaPay" button or Individual Gateways (if this is an availed

feature).

2. Filling up the additional fields (if this is an availed feature)

and choosing their preferred payment Gateway.

3. Filling up the necessary details

required by their chosen gateway (this portion is a domain hosted by the gateway

themselves).

4. Receiving a successful payment notification on their screen after

filling up the necessary details.

Additionally, payors can be redirected to your

website where our hosted buttons are integrated through links or QR codes that we

can provide for you.

To know more about the User Journey for Payors, you may go

over the "12 User Journey for Payor" section in our FAQ guide.

Unfortunately, we do not process refunds. Requests for refunds, returns, and/or exchanges shall be made directly with the merchant concerned, in accordance with the said merchant's own policies regarding the matter.

Your downloadable reports will include the

following information:

• Date

• Reference Number

• Net Amount

• Hold Out

Columns- Percent (%)- Amount (PHP)- Release Date

• Status

• Description

•

Payment Option

GiyaPay can accept payments through:

Credit or

Debit Cards

• Mastercard

• UnionPay

• Visa

e-Wallets

• Alipay

•

GCash

• GrabPay

• PayMaya (coming soon)

• WeChat Pay

Online Banking

•

InstaPay

We can only issue payouts to your nominated bank account and not to e-Wallets.

We do not require a minimum amount. Instead, there is a minimum number of transactions per day needed to receive payouts. For T+2 settlement: at least 10 transactions per day. For T+1 settlement: at least 50 transactions per day.

You may accept payments from outside the Philippines but GiyaPay can only process in Philippine Peso. Payments made in other currencies may be charged an extra conversion fee by Payor's bank abroad to convert payments into Philippine Peso.

Once a chargeback is filed, the value will be deducted from the Security Bond you place upon signing with us. We will hold on to the equivalent value until after 30 days (grace period given by banks) to create a dispute on any of the billed transactions made on their credit card. After 30 days, this amount will then be part of the credited value to your account due on the 31st day together with your daily sales excluding the current day's hold out amount if dispute is deemed to be valid.

Once the value of transactions over the internet

through GiyaPay has exceeded One Million Pesos (PHP 1,000,000.00),we will begin to

Hold Out two percent (2%) per transaction and charge succeeding chargebacks through

that Hold Out value.

You will be provided the disputes made and the

corresponding chargeback value that will be deducted from the total sales due to you

that day.

No, we do not issue receipts to the Payor, rather, receipts are often issued by businesses. GiyaPay is only a payment integrator.

Common reasons why payouts might be delayed

are:

1. Account Verification issues :A GiyaPay representative

will reach out to you directly via email explainingwhy your payout is being held

back.

2. Misunderstanding of the payout schedules: GiyaPay

follows a T+1/2 settlement which means payouts will be processed to your account the

next day or the day after tomorrow.

3. Transfers are

still being processed by the bank: Reflection of the payout will depend

on your receiving bank's schedule. Although this often reflects in your bank within

the day, there are cases that your bank will take one to two (1-2) days to process

the transfer.

4. Incorrect bank account details: A GiyaPay

representative will reach out to you directly via email informing you to update your

bank account details.

Transaction limits are defined by the guidelines of each e-wallet or payment processor. GiyaPay does not define the limit per payment method.

The following banks are allowed for Payouts:

•

Australia and New Zealand Bank (ANZ) – Philippines

• Asia United Bank (AUB)

•

Bangkok Bank - Manila

• Bank of China – Manila• Bank of Commerce

• Banco De

Oro (BDO) Unibank

• Bank of the Philippine Islands (BPI)

• Chinabank

•

Citibank Manila

• CTBC Bank – Philippines

• Development Bank of the

Philippines

• Deutsche Bank - Manila

• EastWest Bank

• HSBC –

Philippines

• JPMorgan Chase Bank Manila

• KEB Hana Bank – Manila

•

LANDBANK

• Maybank Philippines

• Mega International Commercial Bank –

Manila

• Metrobank

• Mizuho Bank – Manila

• MUFG Bank – Manila

• PBCOM•

Philtrust Bank

• Philippine National Bank (PNB)

• Philippine Savings Bank

(PSBank)

• Rizal Commercial Banking Corporation (RCBC)

• Security

Bank

Should your bank not be included in the list, you may email your

customer success manager (CSM) or email us at [email protected].

The most common reasons for failed or declined

payments are:

1. Invalid details: Kindly ensure that the

details you've provided to your chosen gateway are

accurate.

2. Bank declines: Banks have their

own criteria for online payments which are also known to affect other payment

providers. It is encouraged to let Payors call their respective banks to allow

transactions to proceed.

3. Failure to authenticate: Certain

payment methods might require Payors to input OTPs sent via SMS. Failure to input

the required OTP will not allow the transaction to be authorized and will not push

through.

4. Insufficient Funds: Certain payment methods require

to have enough amount in the Payor's account within their system. It is encouraged

to have the Payor check their balance for transactions to proceed.

No, GiyaPay does not deduct withholding tax from your sales. GiyaPay only serves as the payment service provider to facilitate transactions from C2B of our clients. Your prices should already be tax-inclusive.

GiyaPay can only issue receipts of the services rendered to you or the Payor, whoever carries the burden of paying the service fees of GiyaPay.

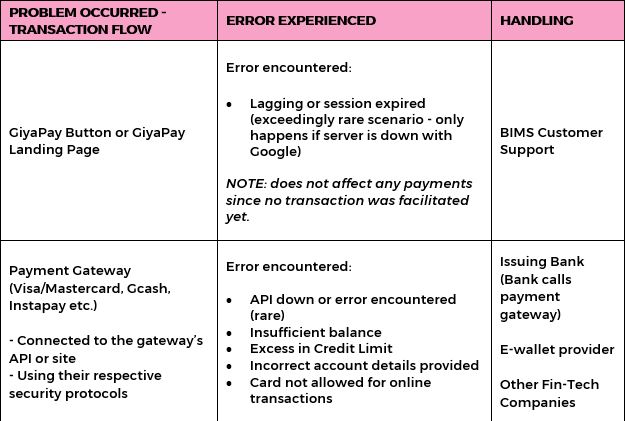

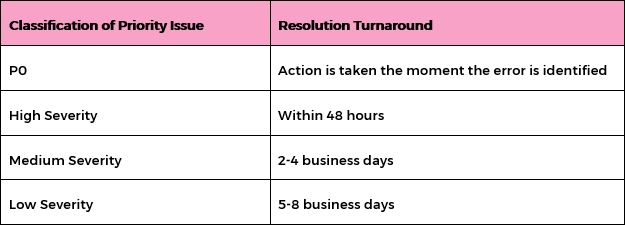

P0

· System is down and is affecting the majority or whole transactions and operations within the

platform.

· Such an issue causes a full outage or makes acritical function

of the product to be unavailable for everyone, without any known

workaround.

High Severity (P1)

· Any defined as

something so critical to the release of the product that you would hold the release

to include/fix it.

· Any fault which causes the failure of acritical

feature that has a substantial impact on the business.

· Significant loss

of visibility of application performance or irreparable loss of data within the

application (such as the System being unreachable from multiple

locations).

· Client declared critical issue with the concurrence of

client and Service Provider Management.

· Any fault that keeps the system

from meeting significantly documented standards or performance

specifications.

· Any fault that keeps the system from meeting regulatory

and safety standards.

Medium Severity (P2)

· Any

fault which causes the failure of anon-critical feature of the

application.

· The application is running at a degraded capacity with a

potential risk of losing critical data.

· Failures in application

performance that requires additional dedicated resources to maintain core

application elements.

· Discovery of application bug with NO short-term

workaround.

Low Severity (P3)

· Loss of

administrative capabilities(non-high/non-medium).

· Loss of full feature

functionality(non-high/non-medium).

· Discover of application bug with a

short-term workaround.

· Any remote upgrade or support not associated with

resolution of a high or medium severity issue.

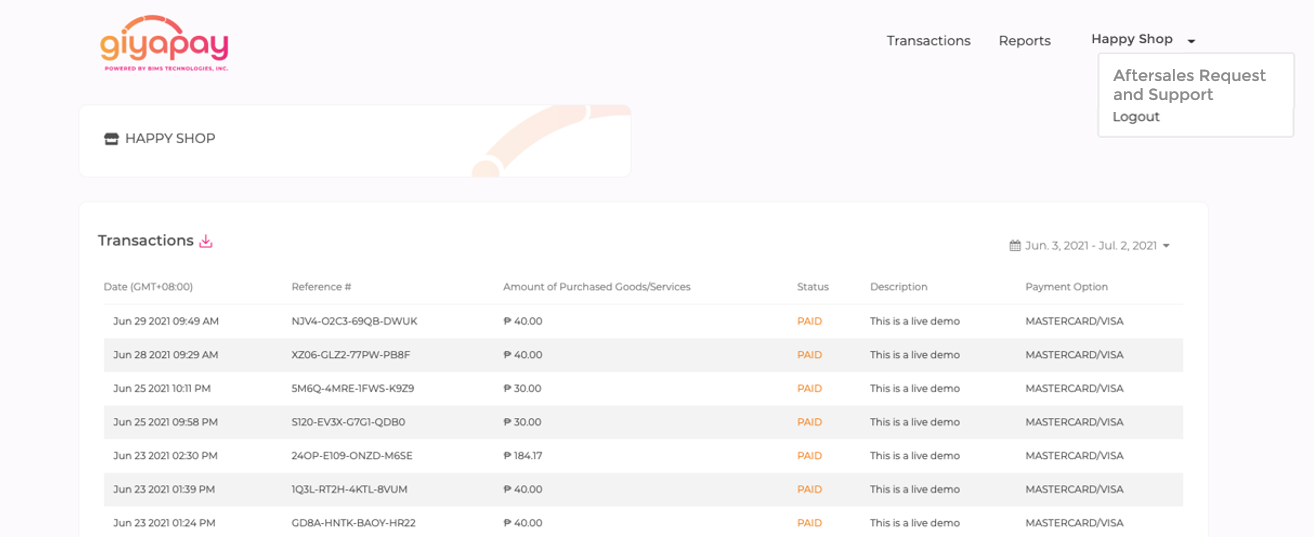

This portion shows how you Merchant Dashboard will

look like:

1. Log in your merchant dashboard with the corresponding information

below:

2.You may download your daily transaction reports as a CSV by clicking on the icon shown below:

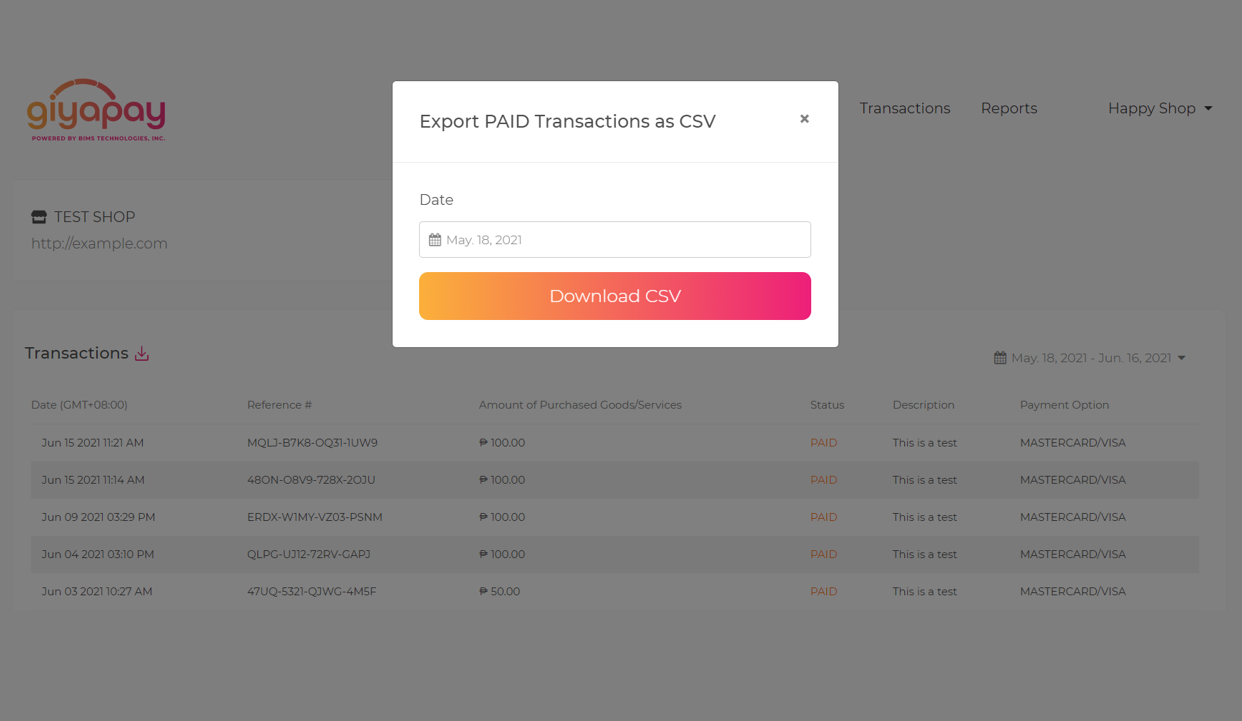

3. Click on "Download CSV to proceed with downloading.

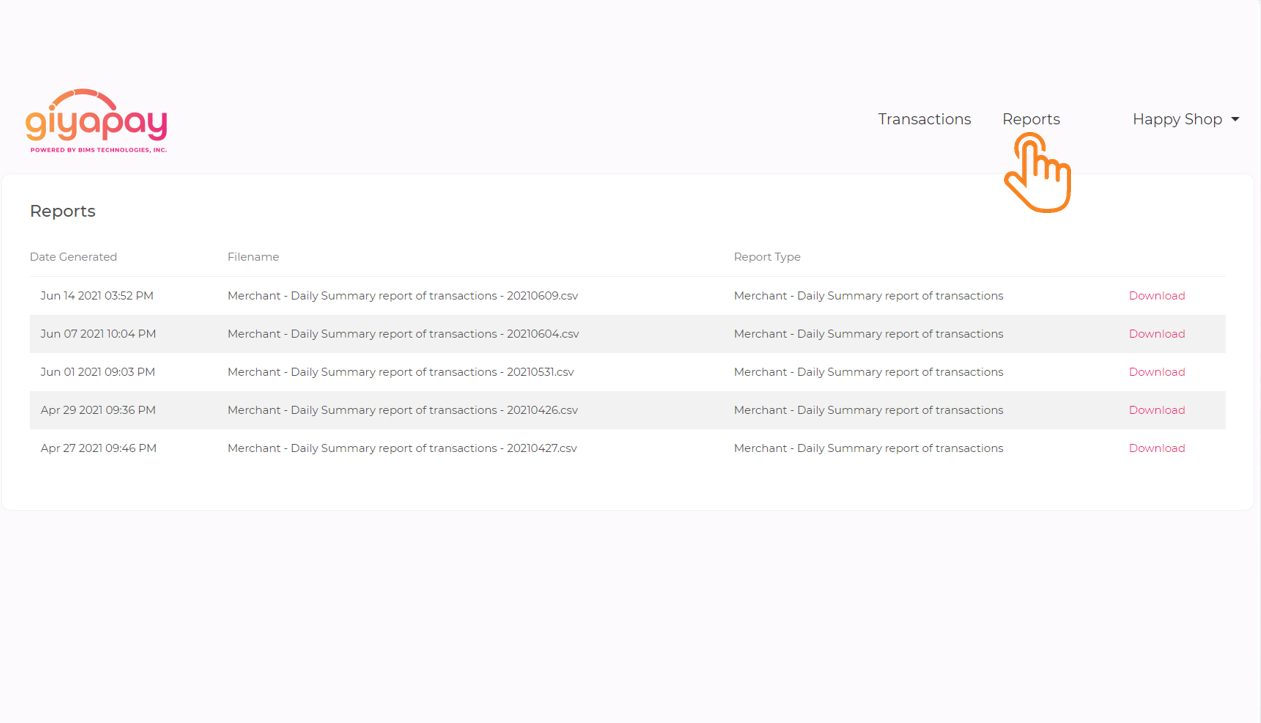

4.To access your daily reports, simply click on the Reports tab found at the upper right portion of your dashboard. These reports are also downloadable.

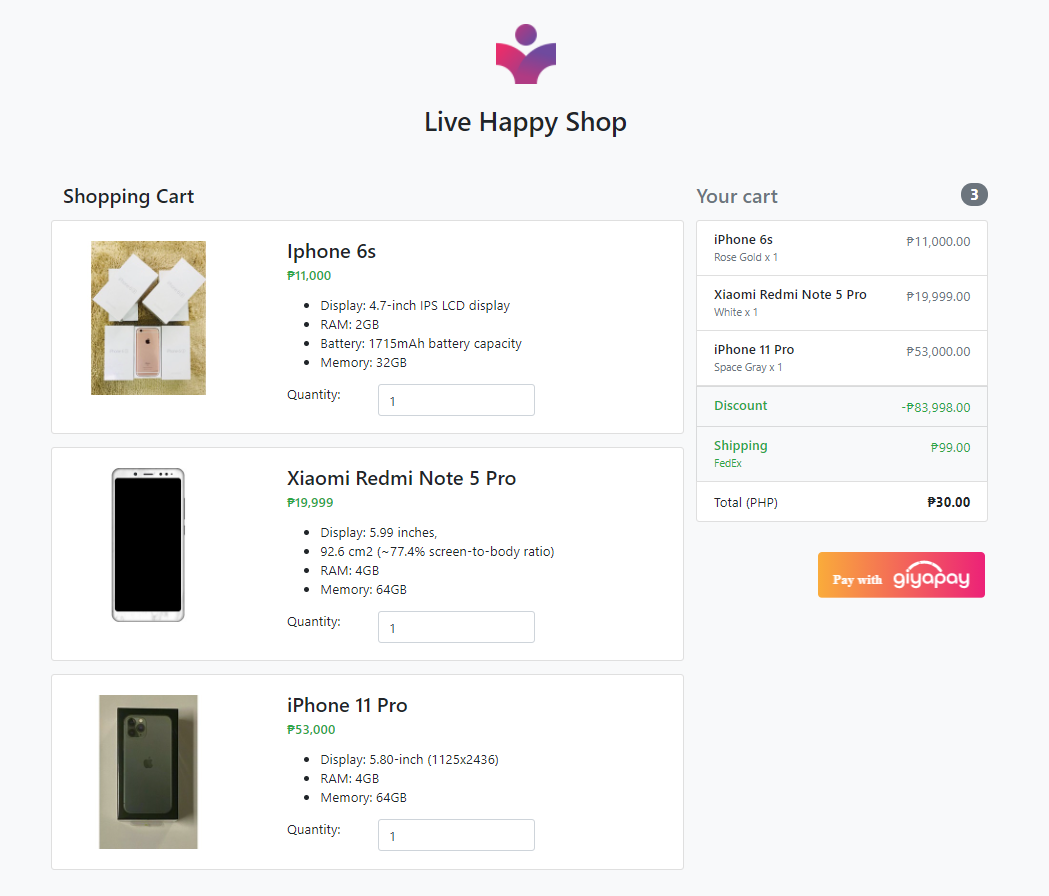

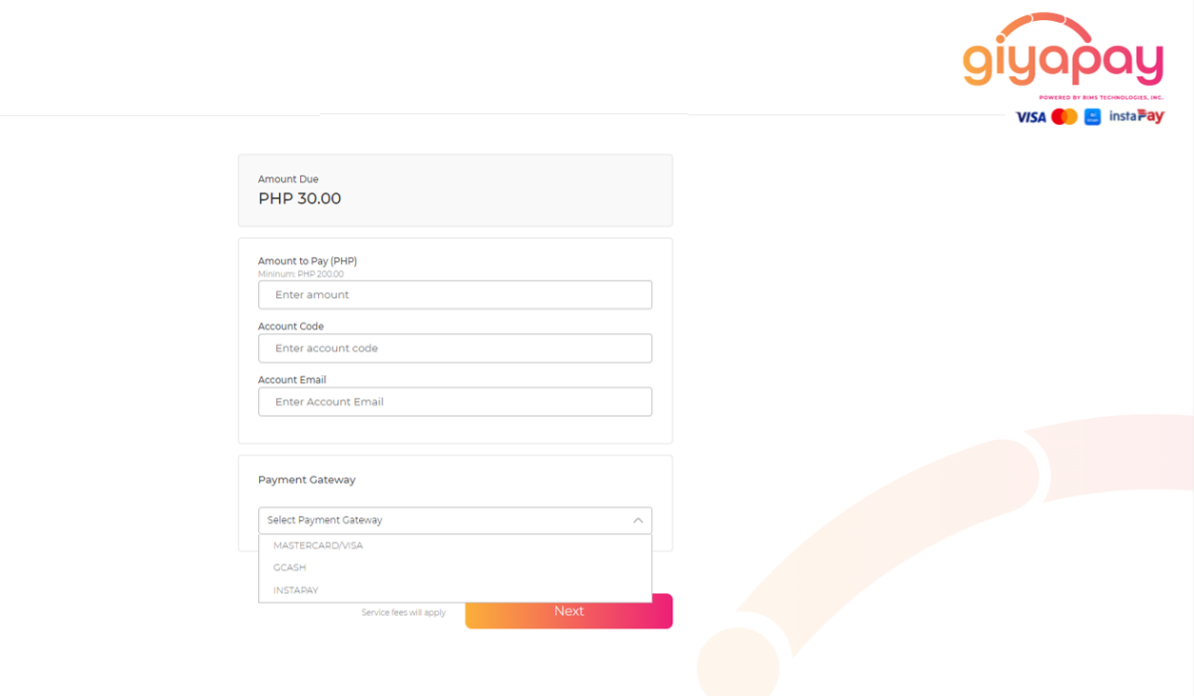

The shown user journey have all add-on features

activated while service fees are charged to Merchant:

1. Click the Pay with

GiyaPay Button

2. Fill the necessary details and select the preferred payment gateway.

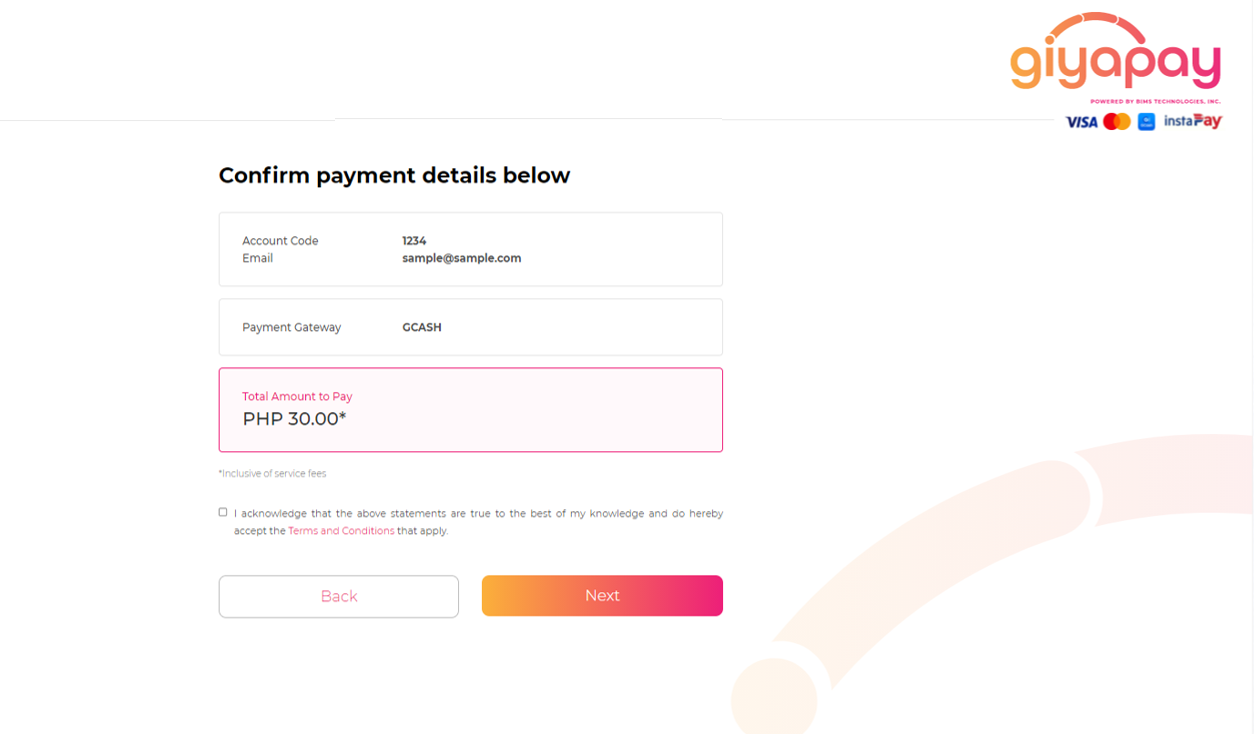

3. Confirm payment details.

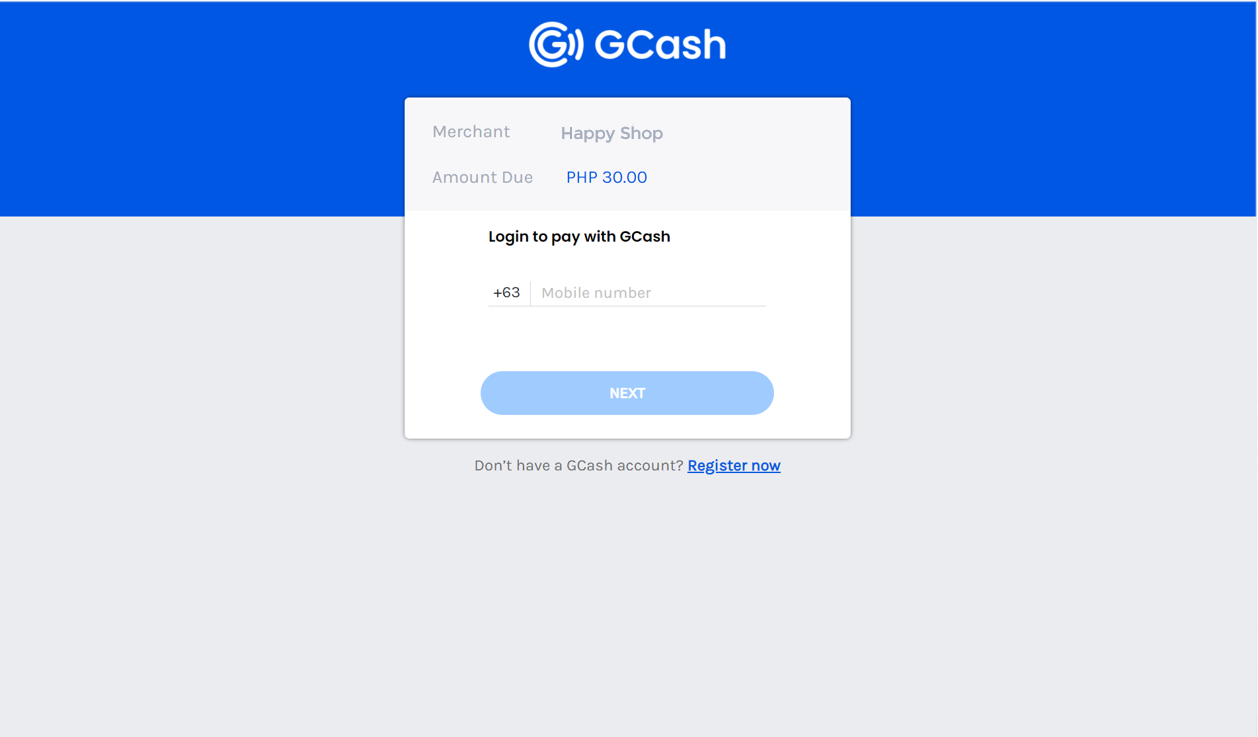

4. Upon clicking the preferred payment gateway, Payor will be redirected to the gateway's hosted page where he/she will fill the necessary details about his/her account.

5.Payor will be notified that payment is successful. This page is usually hosted by the merchants themselves.

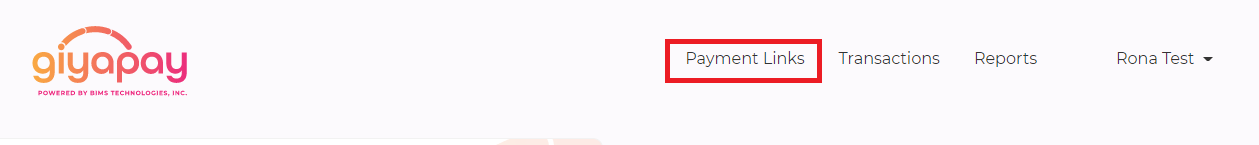

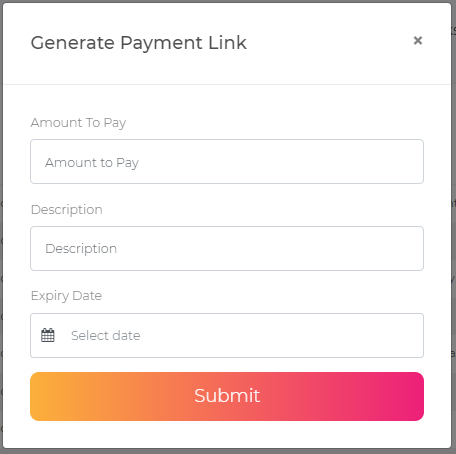

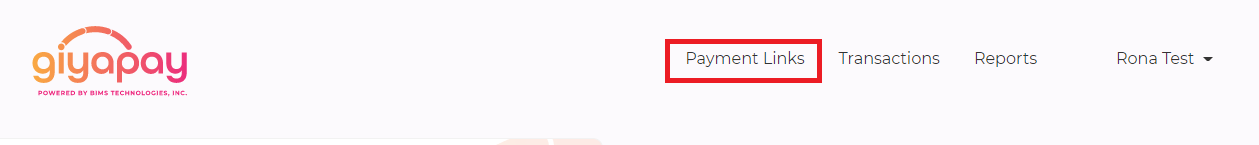

Step 1: Click on the Payment Links menu.

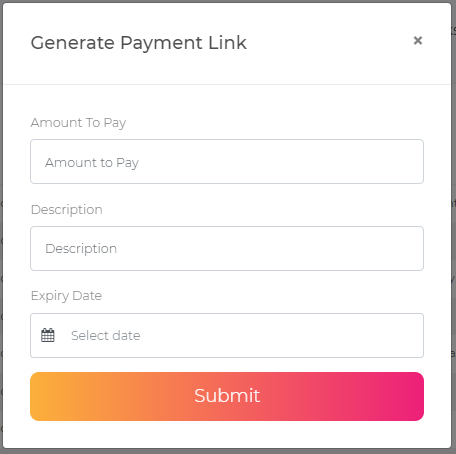

Step 2: Click on the "Generate Payment Link" button found in your dashboard.

Step 3: Fill in the details such as "Amount

to Pay" and other fields.

Note: The "Amount to Pay" field only

allows numbers 0 - 9 and one period character.

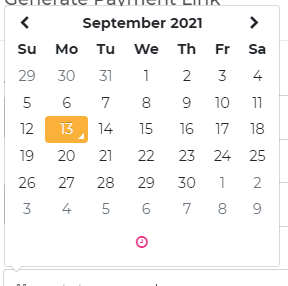

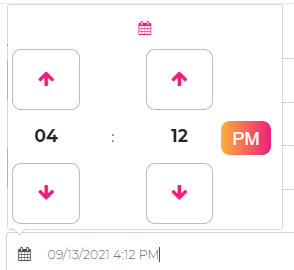

Step 4: Set Expiry Date and Time

Note: When the

"Expiry Date" field is clicked, a calendar popup will show and allows the

user to set the day and time of expiry.

Note: To set the time, click on the pink clock icon on the lower part of the calendar pop up.

Note: Review your inputted details before proceeding to the next step.

Step 5: Click on the Submit button

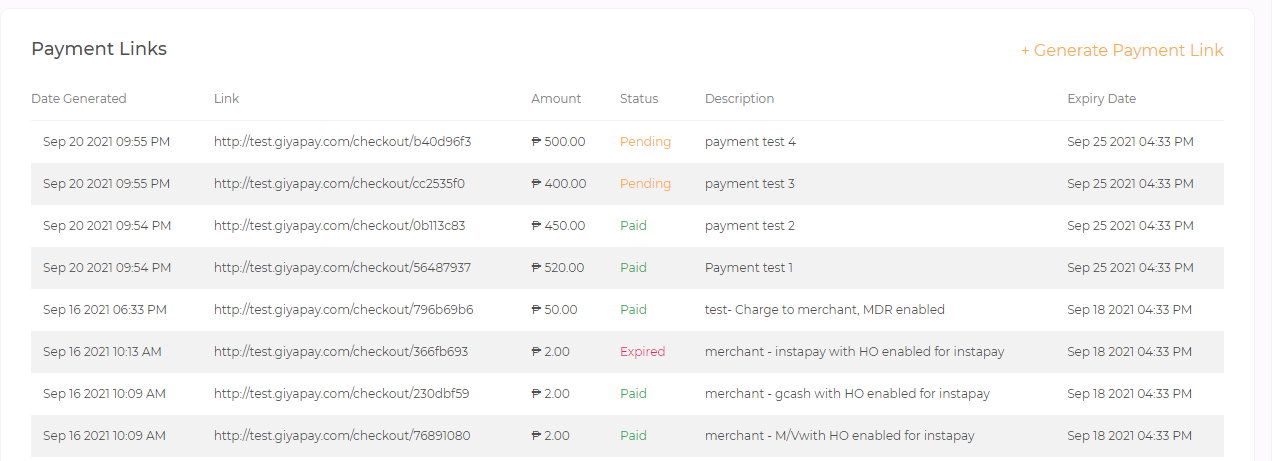

Step 1: Click on the Payment Links Menu.

Note: You will see a table with the following

information:

Date Generated, Link, Amount, Status, Description, and Expiry Date.

You should be able to see the "Generate Payment Link" on your dashboard. Upon generating new links, a new row will be added to the top of the table with the default "Pending" status.

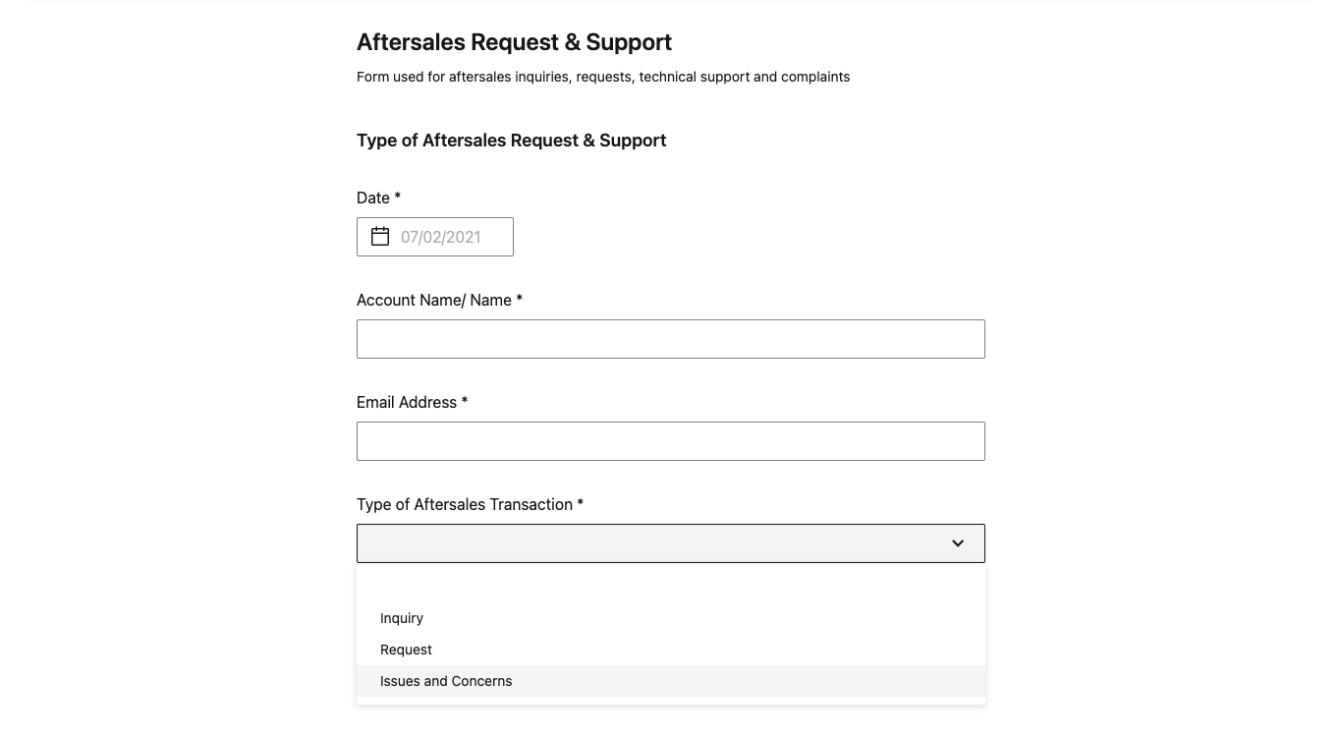

You may find the After Sales Support and Request on your GiyaPay merchant dashboard:

Select the type of Aftersales Support needed: Inquiry, Request, Issues & Concerns